In currently’s quickly-paced monetary atmosphere, enterprises and lenders face increasing exposure to likely defaults and bad financial debt. Irrespective of whether you are a smaller company operator, a lender, or a company finance supervisor, comprehending and handling credit chance is crucial. Instruments like Credit score Hazard Administration, Credit rating Experiences, and Business Credit score Reviews became indispensable in building sound financial conclusions.

???? What on earth is Credit score Danger Administration?

Credit Hazard Management refers to the whole process of figuring out, examining, and mitigating the risk that a borrower or buyer could are unsuccessful to meet their money obligations. This may implement to folks, compact organizations, or significant enterprises.

✅ Crucial Great things about Credit history Danger Management

1. Lessens the chance of Financial Loss

By assessing the creditworthiness of consumers as a result of credit reviews, firms may make educated selections about lending phrases, payment options, or whether to increase credit history at all.

two. Enhances Funds Circulation Balance

Precisely handling credit hazard allows corporations prevent late or missed payments, increasing dollars move and decreasing the need for crisis borrowing.

three. Strengthens Shopper Associations

With a proper credit score evaluation method set up, corporations can supply personalized payment terms dependant on the customer’s credit rating profile—developing belief and lowering disputes.

four. Supports Regulatory Compliance

For financial institutions and businesses, strong credit score possibility practices guarantee compliance with countrywide and Intercontinental monetary rules (e.g., Basel III).

???? The Job of Credit history Reports

A Credit Report is a detailed document of someone's or small business's credit rating record. It includes:

Credit history accounts and payment record

Outstanding debts

Bankruptcies or lawful judgments

Credit rating inquiries

How Credit rating Studies Aid:

Banking institutions and lenders utilize them to approve financial loans

Landlords and residence supervisors use them to vet tenants

Businesses may well overview them for roles involving economic responsibility

Businesses assess them prior to offering trade credit rating

???? Why Organization Credit history Studies Matter

Corporation Credit score Stories supply insights into a company’s monetary health and fitness, like:

Credit history score and payment conduct

Authorized filings or bankruptcies

Economical functionality indicators

Possession and Company Credit Reports company structure

Crucial Added benefits for Companies:

Chance Evaluation: Know if a potential lover or provider is economically secure.

Partnership Vetting: Avoid carrying out business enterprise with higher-threat or fraudulent firms.

Financial commitment Conclusions: Traders depend upon firm credit score info to evaluate risk and return.

???? Smart Uses of Credit history Possibility Knowledge

Companies can use credit history facts to:

Set dynamic credit history limitations for clients

Automate acceptance workflows for financial loans or purchases

Monitor variations in the consumer’s credit history profile with time

Trigger alerts when purchasers display symptoms of financial pressure

???? Who Should Use Credit score Hazard Management Equipment?

Banking companies and lending establishments

B2B businesses presenting trade credit history

Property management firms

Procurement departments

Economic analysts and possibility administrators

Insurance coverage firms

???? Closing Feelings

Inside of a world exactly where economic uncertainty is a constant, Credit Risk Administration, along with detailed Credit history Experiences and Corporation Credit rating Studies, provides you with the upper hand. Whether or not you’re mitigating the potential risk of non-payment or building financial commitment choices, these resources make sure you're working with the ideal companions, customers, and borrowers.

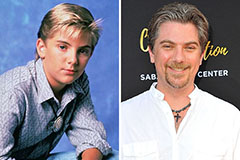

Josh Saviano Then & Now!

Josh Saviano Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now!