The United Arab Emirates (UAE) stands as Probably the most dynamic and fast-evolving economies in the center East. With its swift growth in finance, trade, real-estate, and technological know-how, the need for Credit Possibility Management during the UAE is becoming crucial for businesses and money institutions planning to protected extended-time period stability and expansion.

Regardless if you are a local organization, a multinational functioning within the Emirates, or maybe a financial support company, comprehending and employing powerful credit rating hazard techniques is important.

???? What on earth is Credit Danger Administration?

Credit history Hazard Administration could be the observe of determining, evaluating, and mitigating the risk that a borrower or consumer might are unsuccessful to satisfy their fiscal obligations. While in the UAE's various and extremely globalized marketplace, this involves analyzing the creditworthiness of consumers, checking ongoing money conduct, and changing phrases appropriately to minimize opportunity losses.

✅ Critical Benefits of Credit rating Danger Administration in the UAE

1. Reduces Undesirable Debt and Money Decline

By utilizing credit rating reports and historical facts, companies can prevent high-threat shoppers and decrease the chances of unpaid invoices or bank loan defaults.

two. Supports a Nutritious Credit history Ecosystem

In keeping with UAE Central Lender rules and also the part with the Al Etihad Credit rating Bureau (AECB), credit rating chance management supports a clear, reliable lending and investing ecosystem.

three. Enhances Money Flow and Liquidity

Economical hazard assessment assists companies maintain balanced dollars reserves and lowers the likelihood of money flow disruption due to late payments.

4. Increases Determination-Producing for Trade Credit history

Suppliers and B2B provider vendors while in the UAE gain from credit scoring and fiscal assessments to ascertain suitable credit rating conditions and consumer eligibility.

5. Builds Investor and Stakeholder Confidence

An organization that demonstrates solid danger management procedures is much more more likely to attract investors, favorable financing, and reputable partnerships.

???? Credit score Possibility Administration Across Essential UAE Sectors

• Banking and Finance

UAE financial institutions use subtle models to evaluate individual and company borrowers, making sure compliance with world benchmarks like Basel III.

• Design and Housing

Supplied the funds-intensive mother nature of initiatives, builders and contractors require sturdy credit rating checks for subcontractors, clients, and associates.

• Retail and E-Commerce

As The patron sector expands, retailers supplying acquire-now-pay out-later (BNPL) or credit-centered services really need to evaluate threat to protect profitability.

• Import/Export and Logistics

Trade finance and Intercontinental transactions have to have thorough vetting of consumers across borders to stop non-payment and authorized complications.

???? Applications Utilized for Credit history Chance Management from the UAE

Credit score Experiences from AECB (Al Etihad Credit rating Bureau)

Automatic Credit score Scoring Units

Organization Intelligence Platforms

Danger Monitoring & Early Warning Programs

Intercontinental Organization Credit history Reviews

These instruments provide essential details including payment habits, outstanding financial debt, corporation composition, and danger ratings.

???? Who Need to Use Credit Credit Risk Management UAE history Risk Management?

Monetary Institutions

Federal government and Community Sector Entities

SMEs and Corporates

Real estate property Companies

Experienced Services Providers

Trade and provide Chain Businesses

???? Regulatory and Lawful Context in the UAE

Credit history Risk Administration from the UAE is aligned with:

UAE Central Financial institution Rules

AECB Reporting and Scoring Expectations

Worldwide AML/KYC and threat compliance frameworks

This guarantees transparency, accountability, and danger mitigation throughout all money and business sectors.

???? Conclusion

In a superior-expansion financial state similar to the UAE, the place enterprise is fast-paced and world, Credit score Risk Administration is not just a money safeguard—it’s a competitive edge. From guarding your company from terrible financial debt to setting up robust, credible partnerships, credit history threat applications and techniques empower providers to produce smarter conclusions and develop with assurance.

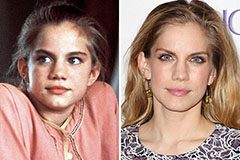

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!