In Dubai’s fast developing and aggressive economical and small business landscape, controlling money threat is much more significant than ever. One of the more crucial aspects of This really is Credit Possibility Management—the observe of examining and managing the chance of monetary loss as a consequence of a client or husband or wife failing to fulfill credit obligations.

Irrespective of whether you are a lender, a real estate company, a B2B provider, or an investor, Credit Hazard Administration in Dubai is essential for retaining powerful income move, protecting belongings, and generating sensible economical decisions.

????️ Why Credit rating Risk Management Is Very important in Dubai

Dubai’s position as a world money hub means corporations on a regular basis have interaction with clients and associates from diverse industries and Worldwide backgrounds. Although this presents large prospect, Furthermore, it introduces threat.

Vital Factors in Dubai's Marketplace:

Higher volume of cross-border transactions

Fast real estate and infrastructure enhancement

Big range of SMEs and startups with various credit history dependability

Regulatory emphasis on monetary transparency and compliance

✅ Great things about Credit history Threat Management in Dubai

1. Shields Against Defaults and Late Payments

By assessing a shopper’s or associate's creditworthiness just before moving into a deal, providers can keep away from unpaid invoices, lawful disputes, and funds move disruption.

2. Supports Regulatory Compliance

Dubai's fiscal institutions run less than frameworks much like the UAE Central Financial institution's pointers and Global criteria for instance Basel III. A strong credit history hazard administration method assists make sure compliance.

three. Allows Intelligent Lending and Trade Credit history Selections

Banking institutions and suppliers can use credit scoring and money knowledge to determine best credit phrases, deposit specifications, or personal loan Credit Risk Management Dubai curiosity rates.

4. Enhances Money Stream and Liquidity

Keeping away from higher-possibility shoppers implies fewer negative debts, resulting in more reliable money circulation and much healthier financial effectiveness.

five. Builds a Much better Business Popularity

Corporations that observe liable credit history administration tend to be more reliable by financial institutions, traders, and companions—leading to much better financing conditions and expansion alternatives.

???? Applications Employed in Credit score Threat Management (Dubai-Unique)

Enterprise Credit history Stories (UAE Firms)

International Credit history Studies (for foreign shoppers)

Automated Risk Scoring Software

Trade Reference Checks

Authentic-time Monitoring & Alerts

???? Industries in Dubai That Gain Most from Credit Hazard Management

Banking & Money Providers

Development & Property

Import/Export and Trading

Logistics & Freight

Retail & E-commerce

Professional Providers

???? Entry to Credit score Data in Dubai

Companies in Dubai can entry:

Credit score experiences from Al Etihad Credit score Bureau (AECB)

Worldwide business enterprise credit info by means of organizations

Non-public hazard administration corporations featuring custom Evaluation and monitoring

These resources deliver crucial info including:

Payment record

Authorized disputes

Outstanding debts

Business construction and ownership

???? Summary

Irrespective of whether you are a economical institution, a company business, or even a expanding SME in Dubai, Credit history Possibility Management is not merely a protective evaluate—it’s a strategic benefit. It permits smarter money choices, reduces losses, and positions your business for sustainable expansion within a aggressive marketplace.

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Burke Ramsey Then & Now!

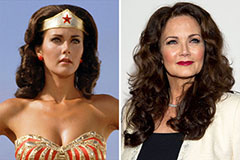

Burke Ramsey Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!