The United Arab Emirates (UAE) stands as Among the most dynamic and fast-evolving economies in the Middle East. With its speedy enlargement in finance, trade, property, and know-how, the necessity for Credit history Hazard Management from the UAE is becoming crucial for companies and financial establishments wanting to protected extended-time period stability and progress.

Regardless if you are a local firm, a multinational functioning in the Emirates, or a financial assistance provider, understanding and applying efficient credit rating possibility tactics is crucial.

???? What exactly is Credit rating Risk Management?

Credit score Chance Administration will be the practice of figuring out, evaluating, and mitigating the danger that a borrower or buyer may possibly fall short to satisfy their financial obligations. From the UAE's numerous and really globalized current market, this consists of analyzing the creditworthiness of purchasers, checking ongoing monetary habits, and modifying conditions appropriately to minimize opportunity losses.

✅ Critical Advantages of Credit history Danger Management while in the UAE

1. Decreases Undesirable Credit card debt and Financial Reduction

Through the use of credit score reviews and historic details, corporations can avoid significant-possibility consumers and decrease the likelihood of unpaid invoices or personal loan defaults.

2. Supports a Nutritious Credit history Setting

Consistent with UAE Central Lender guidelines as well as the part with the Al Etihad Credit rating Bureau (AECB), credit rating possibility administration supports a transparent, trusted lending and trading atmosphere.

three. Boosts Funds Move and Liquidity

Economical risk assessment assists businesses sustain healthful income reserves and cuts down the chance Credit Risk Management UAE of money move disruption on account of late payments.

4. Increases Selection-Producing for Trade Credit rating

Suppliers and B2B provider companies during the UAE reap the benefits of credit rating scoring and monetary assessments to determine ideal credit score phrases and shopper eligibility.

5. Builds Investor and Stakeholder Confidence

A business that demonstrates potent danger management techniques is a lot more very likely to appeal to traders, favorable financing, and honest partnerships.

???? Credit history Risk Management Throughout Key UAE Sectors

• Banking and Finance

UAE banking institutions use innovative styles to evaluate particular person and company borrowers, guaranteeing compliance with world wide benchmarks like Basel III.

• Design and Real Estate

Given the cash-intense character of assignments, developers and contractors require strong credit rating checks for subcontractors, consumers, and partners.

• Retail and E-Commerce

As the consumer sector expands, vendors giving acquire-now-spend-afterwards (BNPL) or credit score-based products and services should assess possibility to protect profitability.

• Import/Export and Logistics

Trade finance and Global transactions need very careful vetting of consumers throughout borders to prevent non-payment and authorized complications.

???? Instruments Used for Credit score Possibility Administration within the UAE

Credit score Stories from AECB (Al Etihad Credit Bureau)

Automated Credit score Scoring Devices

Business Intelligence Platforms

Threat Monitoring & Early Warning Programs

Intercontinental Company Credit Reports

These instruments offer important facts like payment habits, exceptional personal debt, business structure, and chance scores.

???? Who Need to Use Credit history Danger Management?

Economic Institutions

Government and General public Sector Entities

SMEs and Corporates

Real Estate Firms

Skilled Services Providers

Trade and Supply Chain Organizations

???? Regulatory and Legal Context while in the UAE

Credit rating Threat Management in the UAE is aligned with:

UAE Central Bank Polices

AECB Reporting and Scoring Specifications

Global AML/KYC and possibility compliance frameworks

This makes sure transparency, accountability, and possibility mitigation across all money and commercial sectors.

???? Conclusion

In the significant-expansion economic system such as UAE, exactly where business is rapid-paced and world wide, Credit score Hazard Administration is not simply a monetary safeguard—it’s a aggressive gain. From defending your business from negative financial debt to setting up strong, credible partnerships, credit history chance equipment and techniques empower corporations to generate smarter conclusions and grow with confidence.

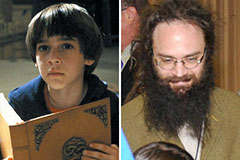

Barret Oliver Then & Now!

Barret Oliver Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!