The United Arab Emirates (UAE) stands as Just about the most dynamic and rapidly-evolving economies in the Middle East. With its fast enlargement in finance, trade, property, and know-how, the need for Credit history Risk Administration inside the UAE has become important for firms and monetary establishments looking to safe extensive-phrase security and growth.

Whether you are a neighborhood company, a multinational working from the Emirates, or perhaps a fiscal service provider, comprehension and utilizing effective credit threat approaches is critical.

???? What's Credit score Threat Management?

Credit Danger Administration is the practice of pinpointing, examining, and mitigating the danger that a borrower or customer may well fail to fulfill their money obligations. From the UAE's assorted and very globalized industry, this entails analyzing the creditworthiness of consumers, monitoring ongoing money conduct, and altering terms appropriately to minimize opportunity losses.

✅ Essential Benefits of Credit rating Danger Administration from the UAE

one. Lowers Poor Credit card debt and Monetary Reduction

By making use of credit score stories and historic information, corporations can steer clear of significant-risk consumers and minimize the probability of unpaid invoices or loan defaults.

2. Supports a Wholesome Credit score Natural environment

In line with UAE Central Lender recommendations as well as the position with the Al Etihad Credit rating Bureau (AECB), credit rating chance management supports a clear, responsible lending and investing ecosystem.

three. Enhances Money Flow and Liquidity

Efficient hazard assessment aids companies maintain balanced dollars reserves and lowers the likelihood of money movement disruption due to late payments.

four. Increases Determination-Producing for Trade Credit history

Suppliers and B2B provider providers while in the UAE get pleasure from credit scoring and money assessments to determine acceptable credit history conditions and buyer eligibility.

five. Builds Trader and Stakeholder Self-assurance

A corporation that demonstrates powerful chance administration tactics is more Credit Risk Management UAE likely to draw in traders, favorable funding, and honest partnerships.

???? Credit history Risk Management Throughout Key UAE Sectors

• Banking and Finance

UAE banking institutions use refined types to assess specific and corporate borrowers, making certain compliance with worldwide expectations like Basel III.

• Building and Property

Offered the capital-intense character of tasks, builders and contractors will need sturdy credit checks for subcontractors, shoppers, and companions.

• Retail and E-Commerce

As The buyer market expands, shops presenting acquire-now-spend-afterwards (BNPL) or credit score-centered expert services must evaluate threat to shield profitability.

• Import/Export and Logistics

Trade finance and Worldwide transactions involve watchful vetting of clients throughout borders to stop non-payment and authorized complications.

???? Equipment Useful for Credit Threat Administration during the UAE

Credit Studies from AECB (Al Etihad Credit rating Bureau)

Automatic Credit history Scoring Systems

Enterprise Intelligence Platforms

Possibility Checking & Early Warning Units

Intercontinental Business Credit Reviews

These resources supply essential knowledge for instance payment habits, remarkable credit card debt, firm construction, and threat ratings.

???? Who Should Use Credit history Chance Management?

Financial Establishments

Federal government and Public Sector Entities

SMEs and Corporates

Housing Companies

Expert Services Suppliers

Trade and provide Chain Corporations

???? Regulatory and Legal Context during the UAE

Credit score Hazard Management during the UAE is aligned with:

UAE Central Bank Restrictions

AECB Reporting and Scoring Specifications

Intercontinental AML/KYC and danger compliance frameworks

This makes certain transparency, accountability, and danger mitigation across all economical and commercial sectors.

???? Conclusion

In the high-development financial state such as the UAE, wherever business is quickly-paced and world wide, Credit history Hazard Administration is not merely a financial safeguard—it’s a aggressive gain. From protecting your organization from lousy debt to making robust, credible partnerships, credit history chance tools and procedures empower firms for making smarter decisions and grow with self esteem.

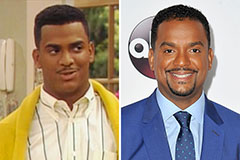

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Charlie Korsmo Then & Now!

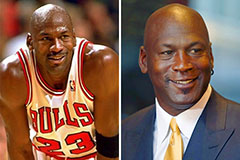

Charlie Korsmo Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!