In today's digitally pushed economy, economic threat is no longer restricted to current market volatility or credit score defaults—it also features knowledge breaches, cyberattacks, and bad details governance. As monetary transactions and conclusions turn out to be more and more depending on electronic programs, the value of Secure Details Management in Monetary Possibility Management (FRM) can't be overstated.

Protected info administration refers back to the structured handling, storage, and safety of delicate fiscal facts. It’s not just a compliance necessity—it’s a strategic requirement that strengthens danger mitigation frameworks and makes certain business continuity.

Here's the key benefits of integrating secure knowledge management into your money hazard administration strategy:

one. Minimizes Cyber and Data Breach Dangers

Info breaches can cause large money and reputational destruction. Protected facts management procedures—for example encryption, obtain Command, and regular audits—help prevent unauthorized usage of delicate economic details, defending your Corporation from fraud, ransomware, and insider threats.

two. Improves Regulatory Compliance

Regulations like GDPR, PCI DSS, SOX, and Basel III demand from customers safe information managing and reporting. Secure data administration ensures that money knowledge is stored, processed, and shared in accordance with authorized standards, reducing the potential risk of fines and sanctions.

3. Enables Exact Economic Analysis

Money danger administration depends greatly on details accuracy. With properly-managed and secured information programs, corporations can execute superior-top quality analytics to forecast threats, keep track of current market circumstances, and assess fiscal health without having the chance of corrupted or misplaced information.

four. Builds Stakeholder Trust

Buyers, associates, and clientele are more assured in firms that display potent data stability and risk controls. Safe information administration shows that your Corporation takes financial accountability very seriously, which boosts stakeholder rely on and supports long-phrase expansion.

five. Boosts Business Continuity Setting up

Money danger administration isn’t nearly avoidance—it’s also about Restoration. Secure data backups, catastrophe Restoration designs, and are unsuccessful-Harmless programs make certain that essential economic knowledge continues to be intact and available through crises, enabling faster response and continuity of functions.

six. Supports True-Time Threat Checking

Contemporary chance management relies on true-time data processing. With protected, centralized info devices, companies can observe monetary risk indicators in serious time, letting quicker selections in reaction to rising threats like market crashes, Trade price shifts, or liquidity challenges.

seven. Shields Mental Residence and Aggressive Edge

Money details is a lot more than simply figures—it incorporates pricing models, expenditure tactics, and proprietary algorithms. Safe info management makes sure this mental house is protected from competition and cybercriminals, preserving aggressive edge and innovation.

8. Allows Risk-free Collaboration and Integration

Economic ecosystems are more and more interconnected. Protected facts management allows enterprises to securely share monetary information and facts with associates, auditors, regulators, and service suppliers via safe APIs, cloud solutions, and encrypted channels—making certain efficiency devoid of compromising security.

Conclusion

Money Danger Management and Safe Details Management go hand in hand. With no potent info protection techniques, even one of the most subtle risk versions and money strategies can disintegrate. By integrating secure info management into your threat framework, you not merely guard sensitive data Secure Data Management and also empower your Group for making smarter, a lot quicker, and safer economical selections.

Danny Tamberelli Then & Now!

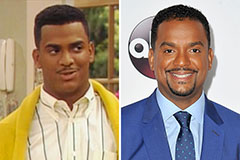

Danny Tamberelli Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now!